# Introduction to Best Wallet Token Price Prediction

In the ever-evolving landscape of cryptocurrencies, token price prediction has become an essential aspect for investors and analysts alike. The Best Wallet Token (BWT) is one of the promising digital assets in this genre. This article aims to explore the various dimensions of BWT, examine factors influencing its price, and delve into analytical methodologies for effective price prediction.

## Understanding Best Wallet Tokens

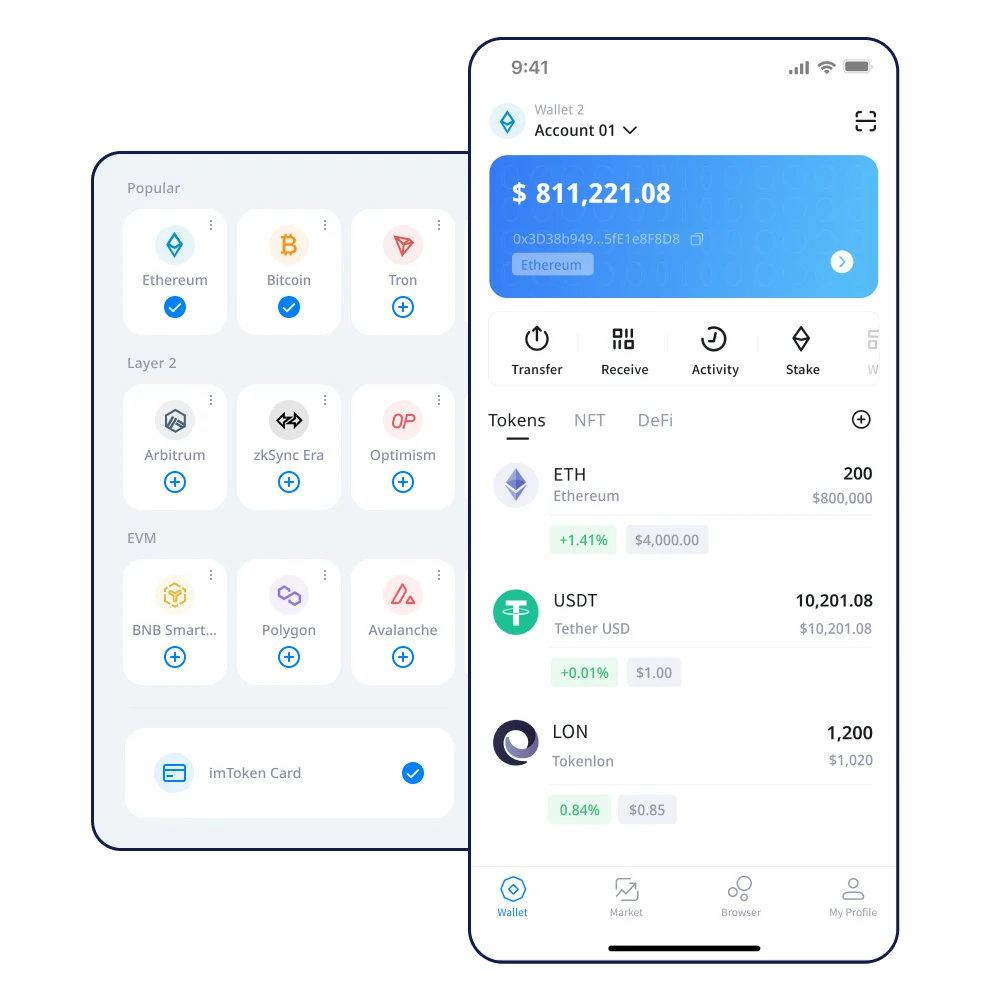

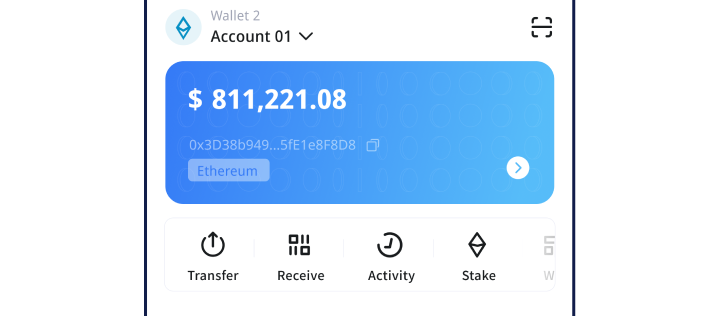

Best Wallet Tokens belong to a category of digital assets that are specifically integrated into cryptocurrency wallets. These tokens often serve multiple purposes, including transaction fees, rewards, and governance rights within their ecosystem. The BWT token model provides users with an exceptional utility experience, allowing for faster transactions, lower fees, and enhanced security features.

### Unique Features of BWT

One of the significant selling points of BWT is its focus on enhancing user experiences in managing cryptocurrency portfolios. Users of wallets equipped with BWT can trade, stake, and earn incentives, making it a one-stop solution for cryptocurrency management. These features amplify user engagement and drive adoption, which may positively affect the token’s price.

## Factors Affecting Token Prices

Token prices are influenced by a multitude of factors, including market sentiment, technological developments, broader economic conditions, and regulatory frameworks. Understanding these aspects is crucial for making informed predictions about BWT.

### Market Sentiment

Sentiment analysis is a critical factor when it comes to cryptocurrency pricing. The cryptocurrency market is especially volatile, where the mood can shift dramatically within hours. Social media platforms, news articles, and influencer endorsements can rapidly alter perceptions, making sentiment analysis a valuable tool for predicting price movements of BWT.

### Technological Developments

The underlying technology of any cryptocurrency, including BWT, plays a significant role in its valuation. Improvements in security, speed, and scalability directly impact user satisfaction and trust. Regular upgrades and partnerships with other blockchain projects can boost BWT’s credibility, contributing to price increases.

### Economic Conditions

Broader economic indicators, such as inflation rates, stock market performance, and fiat currency stability, can also affect investor behavior in the cryptocurrency space. When traditional investments appear unstable, many investors may shift their focus to cryptocurrencies like BWT, potentially driving up prices.

### Regulatory Environment

Regulations surrounding cryptocurrencies are still in a state of flux across the globe. Countries that adopt favorable policies towards digital currencies can create a conducive environment for tokens like BWT. Conversely, negative regulations can deter investment and result in price declines.

## Analytical Models for Price Prediction

When it comes to predicting the price of BWT and similar tokens, various analytical methodologies exist. Each of these methods has its own strengths and weaknesses, and understanding them provides better insights for investors.

### Fundamental Analysis

Fundamental analysis involves examining the intrinsic value of a token by studying the underlying technology, use cases, and the overall market environment. For BWT, factors such as the wallet’s user base, transaction volumes, and partnerships should be considered. By assessing these elements, investors may make educated guesses about BWT’s future price.

### Technical Analysis

Technical analysis relies on historical price data and trends to forecast future movements. By utilizing charts, indicators, and patterns, traders can identify potential entry and exit points for BWT. Moving averages, Relative Strength Index (RSI), and Bollinger Bands are popular tools used in this analysis.

### Sentiment Analysis

Given the volatility of cryptocurrencies, sentiment analysis has gained traction as a viable method of predicting price movement. This form of analysis employs natural language processing (NLP) to gauge public sentiment on social media platforms and news outlets. A positive sentiment toward BWT can indicate a potential price increase, while negative sentiment may suggest a downturn.

### Machine Learning Models

Machine learning techniques, including supervised and unsupervised algorithms, are increasingly being applied in token price predictions. By training models on historical data, algorithms can identify patterns and make real-time predictions. For BWT, factors such as social media sentiment, market trends, and trading volumes can be input variables for these models.

## Case Studies in Price Prediction

Investigating past instances of price movements can provide invaluable insights for predicting future trends. Case studies around historically significant events can illuminate patterns relevant to BWT.

### Bitcoin Market Movements

The price of BWT is not immune to the market sway of dominant cryptocurrencies like Bitcoin (BTC). When Bitcoin experiences bullish trends, it usually propels lesser-known tokens upward. Analyzing BWT’s price movements in correlation with Bitcoin’s can yield insights into its volatility and potential future performance.

### Significant Partnerships

Numerous cryptocurrency projects have witnessed significant price surges following strategic partnerships. If Best Wallet announces collaborations with established financial institutions or blockchain projects, it is reasonable to predict a price increase for BWT. Tracking such developments will remain vital for accurate price forecasts.

### Regulatory Impact

Regulatory news significantly impacts token prices. A retrospective analysis of BWT’s price action around major regulatory events can help identify its sensitivity to legal environments. Such analysis will aid in forecasting how forthcoming regulatory developments may impact its value.

## The Role of Community Engagement

The strength of a cryptocurrency’s community often influences its market performance. Engaged communities can drive demand and contribute to price stability or growth.

### Importance of Community

For BWT, a strong and active community serves as a backbone to its success. Membership drives demand through increased visibility and adoption. Platforms like Discord, Telegram, and Twitter become vital spaces for the community to share information, updates, and expectations surrounding BWT.

### Community Initiatives

Engaging community initiatives such as airdrops, loyalty programs, or contests can further enhance user engagement. These strategies not only promote the token but also provide an incentive for users to hold onto their investments, which can lead to decreased selling pressure and stability in BWT prices.

## Risks and Challenges

While the prospects for BWT appear promising, potential investors should also be aware of the accompanying risks. Understanding these challenges is critical to achieving a balanced outlook.

### Market Volatility

The cryptocurrency market is notoriously volatile. Extreme price fluctuations can occur in a single day, creating a perilous environment for investors. BWT is no exception, and investors should be prepared for significant price swings whilst managing their risk exposure.

### Regulatory Risks

As mentioned earlier, the regulatory landscape remains uncertain. Future crackdowns on cryptocurrencies could lead to adverse impacts on BWT’s market position. Investors should stay abreast of global regulatory developments to effectively mitigate this risk.

### Technological Risks

Technological vulnerabilities, including hacks or software failures, pose risks to digital assets. A breach in the wallet’s security or a failure in the underlying blockchain could drastically affect the token’s value and erode user trust. Implementing robust security measures is paramount to mitigating these risks.

## Long-term Outlook for Best Wallet Token

Examining the long-term prospects for BWT involves analyzing various factors including market maturation, evolving technology, and community dynamics.

### Market Maturation

As the cryptocurrency market matures, we may witness the emergence of more sophisticated wallets and tokens. BWT’s survival over the long term will depend on its ability to innovate and adapt. A proactive approach to technological advancements and user demands will be vital.

### Evolving Technology

The ongoing development of blockchain technology can either pose a threat or an opportunity for BWT. By integrating cutting-edge features, BWT can strengthen its foothold in the market. Collaborations that enhance technological capabilities will be crucial for long-term sustainability.

### Community Dynamics

Engaged and passionate communities often determine the success of a token. If BWT can foster a strong community ethos while encouraging active participation, it has a promising prospect for long-term success.

## Conclusion

The price prediction for Best Wallet Token is a multifaceted endeavor influenced by a wide array of factors and methodologies. By employing fundamental and technical analyses along with sentiment evaluation, users can gain insights into potential price movements. However, the inherent risks, including market volatility, regulatory changes, and security vulnerabilities, remain critical considerations. As the cryptocurrency landscape evolves, BWT’s future will depend heavily on its ability to adapt, innovate, and engage its community effectively. By keeping abreast of industry developments and trends, investors can make more informed decisions in the quest for gains in this dynamic market.