## Understanding Plus Token Wallet: A Deep Dive

In the ever-evolving landscape of cryptocurrency, wallets play a pivotal role—acting as the bridge between users and digital assets. Among various cryptocurrency wallets, the Plus Token wallet has garnered significant attention and debate within the crypto community. This article aims to provide a comprehensive overview of the Plus Token wallet, dissecting its features, controversies, and implications for the future of digital finance.

### What is Plus Token Wallet?

The Plus Token wallet was introduced in 2018 as a multi-currency wallet capable of storing a broad spectrum of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and various altcoins. Its primary appeal lies in its user-friendly interface and built-in investment features. Unlike traditional crypto wallets, the Plus Token wallet includes a unique cryptocurrency investment scheme that promised high returns, drawing many users, particularly in Asia.

### Features of Plus Token Wallet

#### Multi-Currency Support

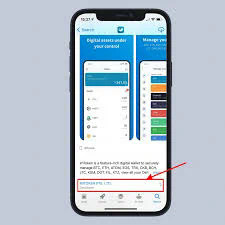

One of the standout features of Plus Token is its support for multiple cryptocurrencies. The wallet accommodates a wide range of tokens, enabling users to manage diverse portfolios without the need for multiple wallets. This feature addresses a common pain point among cryptocurrency investors—the hassle of dealing with various wallets for different assets.

#### User-Friendly Interface

The design and usability of the Plus Token wallet cater to both novice and experienced users. The interface is intuitive, making it easy for users to navigate through various features, manage their cryptocurrency, and execute transactions. The user-centric approach reflects a growing trend in FinTech, where accessibility and ease of use are prioritized.

### Investment Features: Tempting Promises or Risky Ventures?

#### High-Return Investment Program

Plus Token gained traction, initially, due to its promises of high returns on investments, often described as “arbitrage trading.” The wallet operated on a unique business model that claimed to generate profits for its users through a complex trading system. While this attracted many investors, it raised red flags and sparked discussions around the legitimacy of such claims.

#### Ponzi Scheme Allegations

As the Plus Token wallet gained popularity, it also attracted scrutiny. Numerous reports emerged alleging that the wallet operated as a Ponzi scheme. The business model relied on continuously attracting new investors to pay returns to earlier ones, rather than profiting from genuine trades. This raises critical ethical questions and highlights the need for regulatory oversight within the cryptocurrency space.

### Community Reception: A Double-Edged Sword

#### Enthusiastic Followers

Despite the controversies, a significant user base remained loyal to Plus Token. For many, the allure of high returns and the multipurpose nature of the wallet outweighed the risks. Positive reviews and testimonials circulated on social media platforms, creating an echo chamber that bolstered user confidence. This aspect underscores the psychological factors at play in investment choices, driven largely by herd behavior and social validation.

#### Critics and Skeptics

Conversely, many in the cryptocurrency community remained critical of Plus Token. Skeptics often pointed to the lack of transparency regarding the wallet’s operations, its vague business model, and its eventual issues with withdrawals. These criticisms highlight the importance of due diligence and risk assessment in the fast-growing cryptocurrency market.

### The Regulatory Landscape: Navigating a Grey Area

#### Current Regulatory Environment

Cryptocurrency wallets and related investment programs exist within a nebulous regulatory framework. Various jurisdictions adopt different approaches to governing cryptocurrencies, leading to inconsistencies and potential exploitation. Plus Token’s operations have sparked discussions about the need for greater regulation and clarity in the space to protect consumers and investors.

#### The Role of Governments

As the crypto market expands, governments are increasingly tasked with establishing rules to govern digital currencies and associated platforms. Countries like China have cracked down on cryptocurrency-related activities, while others embrace innovation and propose regulations that promote responsible use. This regulatory landscape presents challenges for platforms like Plus Token, which may struggle to adapt to evolving legal frameworks.

### Security Concerns: Protecting Your Assets

#### Security Features of Plus Token

Security is paramount in the crypto ecosystem, especially with the rise of hacking incidents and scams. Plus Token employs standard security measures like two-factor authentication (2FA) and encryption. However, users are encouraged to remain vigilant, as the decentralized nature of blockchain does not inherently guarantee safety.

#### Past Hacking Incidents

Despite its security measures, the wallet did not escape issues related to hacking and unauthorized access. Users have reported incidents of funds being drained from their wallets, raising questions about the overall integrity of the platform. Such vulnerabilities emphasize the inherent risks associated with any online financial service and the crucial need for individual accountability in securing personal assets.

### The Fall of Plus Token: Lessons Learned

#### The 2020 Collapse

By mid-2020, plus token wallet became synonymous with scandal and financial loss. The platform faced allegations of fraud, and many users lost significant amounts of money. Reports indicated that the team behind Plus Token had vanished, leading to widespread panic among investors. This incident serves as a cautionary tale for those who heed the siren calls of guaranteed returns.

#### Investment Caution

The collapse of Plus Token reinforces the critical lesson that high returns often come with high risks. Novice investors are encouraged to educate themselves about investment principles, take calculated risks, and remain skeptical of promises that seem too good to be true. Due diligence in researching platforms before engagement is essential in an industry rife with scams.

### The Future of Cryptocurrency Wallets: Innovations and Trends

#### Emergence of Decentralized Wallets

As trust in centralized platforms wanes, the demand for decentralized wallets is gaining traction. These wallets offer users greater control over their assets and reduce the risks associated with centralized management. Innovations in this space could drastically shift how investors perceive and interact with cryptocurrency.

#### The Role of Smart Contracts

Smart contracts, enabled by blockchain technology, offer exciting potential for enhancing wallet features and improving security. By automating transactions and eliminating intermediaries, smart contracts can provide greater efficiency, transparency, and security. Future cryptocurrency wallets may evolve to integrate these technologies deeply.

### Conclusion: Navigating the Crypto Landscape

The journey of Plus Token wallet reflects broader themes within the cryptocurrency space, including trust, innovation, and risk. As the landscape continues to evolve, participants must remain informed and vigilant. The lessons learned from Plus Token’s rise and fall underscore the importance of transparency, security, and regulatory frameworks, which will play essential roles in shaping the future of digital finance. By understanding the complexities of platforms like Plus Token, users can make more informed decisions and navigate the exciting yet volatile world of cryptocurrency more effectively.