# Understanding Token Imports in Coinbase Wallet

The cryptocurrency landscape has been marked by rapid developments, particularly in how users interact with decentralized applications (dApps) and manage their digital assets. One critical aspect of this ecosystem is the ability for users to manage various tokens within their wallets. Coinbase Wallet, a self-custody wallet provided by Coinbase, offers users the flexibility to import tokens, providing them access to a plethora of assets outside the traditional confines of popular cryptocurrencies like Bitcoin and Ethereum. This article delves into the process, significance, and implications of importing tokens into the Coinbase Wallet.

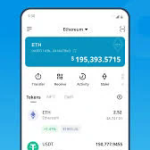

### What Is Coinbase Wallet?

Coinbase Wallet serves as a standalone digital wallet that enables users to manage their cryptocurrencies and digital assets securely. Unlike the Coinbase exchange, which acts as a custodian for user funds, Coinbase Wallet gives users complete control over their private keys. This self-custody model empowers users to interact with decentralized finance (DeFi) platforms, store non-fungible tokens (NFTs), and manage multiple tokens that might not be natively supported by the Coinbase exchange.

### The Importance of Token Management

In the diverse world of cryptocurrencies, token management is crucial for investors and users who want to engage with different blockchain ecosystems effectively. Tokens are often designed for specific functionalities—like governance in decentralized applications, utility for services, or representation of assets in the real world. By importing tokens into their wallets, users ensure that they can participate in various token-related activities such as trading, staking, and earning rewards.

### The Mechanics of Importing Tokens

Importing tokens into Coinbase Wallet involves several straightforward steps. The process typically requires the user to access their wallet app, navigate to the tokens or assets section, and select the option to import. Users can either search for the token using its contract address, which is a unique identifier for tokens on the blockchain, or find it in a predefined list of supported assets. This ease of access is a significant advantage, allowing users to manage a broad spectrum of tokens without extensive technical knowledge.

### Understanding Token Standards

To appreciate the significance of importing tokens, one must understand token standards such as ERC-20, ERC-721, and ERC-1155. ERC-20 is the standard for fungible tokens on the Ethereum blockchain, meaning every token is identical in value and representation. In contrast, ERC-721 defines non-fungible tokens (NFTs), which are unique and cannot be exchanged on a one-to-one basis. ERC-1155 allows both fungible and non-fungible tokens to coexist, enhancing interoperability. Understanding these standards helps users comprehend the assets they are importing and the associated functionalities.

### Token Compatibility and Interoperability

Token compatibility is a crucial factor when importing tokens. Coinbase Wallet supports a wide array of tokens primarily built on the Ethereum blockchain, but it also accommodates tokens from other networks, such as Binance Smart Chain, Polkadot, and more. Each network has its own ecosystem with distinct token standards and dApps. Users must be mindful of these differences to avoid transaction issues or loss of funds, ensuring that they import tokens compatible with the networks they intend to interact with.

### The Role of Smart Contracts

From a technical perspective, importing tokens involves interaction with smart contracts. A smart contract is a self-executing contract with the terms written directly into code. When a user imports a token, they interact with the smart contract of that token, which governs all transactions associated with it. Understanding how these contracts function can help users make informed decisions about token management, fees, and potential risks.

### Wallet Security Considerations

While Coinbase Wallet provides robust security features, users must remain vigilant about the risks associated with token imports. Phishing attempts, malicious smart contracts, and fake token replicas are prevalent threats in the crypto space. Users should only import tokens from reliable sources, verify contract addresses, and consider using hardware wallets for added security. Understanding security best practices is essential for safeguarding assets in an environment that is often susceptible to fraud and theft.

### The Future of Tokenization

As the cryptocurrency ecosystem evolves, the importance of tokenization continues to expand. Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain. This trend is poised to transform various industries, including real estate, art, and finance, by providing greater liquidity and accessibility. Users who understand how to import and manage tokens will be better positioned to take advantage of these emerging opportunities.

### Engaging with Decentralized Finance (DeFi)

The ability to import tokens into Coinbase Wallet opens avenues for users to engage with DeFi platforms. DeFi provides users with traditional financial services like lending, borrowing, and trading without intermediaries, relying heavily on smart contracts. Users can import tokens to lend them for interest, participate in yield farming, or trade through decentralized exchanges (DEXs). Understanding the landscape of DeFi and the role of various tokens is crucial for maximizing the benefits of decentralized finance.

### Non-Fungible Tokens (NFTs) in Coinbase Wallet

In addition to fungible tokens, Coinbase Wallet supports the management of NFTs. These unique digital assets represent ownership of a specific item, whether it be digital art, collectibles, or virtual real estate. The process of importing NFTs is relatively similar to that of fungible tokens, offering users the ability to showcase their collections and interact with NFT marketplaces directly from their wallets. With the growing popularity of NFTs, understanding how to manage these assets becomes increasingly relevant.

### The Impact of Regulatory Environment

The regulatory landscape surrounding cryptocurrencies and tokens is continually shifting. Governments worldwide are formulating policies that could impact token imports and what users can do with their digital assets. Compliance with regulatory frameworks is essential to avoid potential pitfalls. Users should remain informed about local regulations and how they might affect their ability to import, trade, or utilize certain tokens.

### Conclusion: The Evolution of Wallet Functionality

The ability to import tokens significantly enhances the functionality of wallets like Coinbase Wallet, making them versatile tools for managing an increasingly complex array of digital assets. Within a broader context, the evolution of wallets reflects the shifting paradigms in how users interact with blockchain technology. As the cryptocurrency space continues to innovate, the implications of importing tokens will play a vital role in shaping the future of digital asset management, fostering greater user adoption, and driving the growth of decentralized ecosystems.

### Final Thoughts

In navigating the evolving landscape of cryptocurrencies, the capability to import tokens into platforms such as Coinbase Wallet is reflective of a broader trend towards decentralization and user empowerment. With a robust understanding of the processes, implications, and best practices involved in token management, users are better equipped to thrive in the ever-changing world of digital assets. This understanding not only enables them to safeguard their investments but also positions them to engage effectively with a wide array of business models and use cases emerging within the blockchain space.